The UK is being battered by some torrential rain, and it looks like the wet weather is on for the next week or so. Hopefully, you’ve managed to avoid the worst of the flooding, or protected your property before the rain fall. If not, your business premises could be badly damaged, meaning you need to make an insurance claim.

Here’s what action to take in the immediate aftermath of a flood, alongside information on how to make a flood insurance claim.

Immediately after the flood

- If your house has suffered damage, try to do what you reasonably can to prevent further damage and reduce risk of harm to others, but know your limits and don’t put yourself or others at risk by trying to move or repair something that needs a professional.

- However, before you employ someone to remove debris or start any repairs, make sure they’re one of your insurers recommended tradesmen else the might refuse to pay out.

- Check both your buildings and contents insurance as you may have to claim on both. If so, you’ll probably also have to pay an excess on both.

- If your car has been damaged by falling debris, check with your insurer regarding how best to get it recovered and/or repaired. DOn;t try to drive it yourself if it’s not roadworthy.

How to make a claim

The average claim for flood damage stands at around £17,000 – so you don’t want to do anything that will invalidate your claim. So follow these simple steps to make sure your claim is successful and covers everything…

- Contact your insurer as soon as you can. Most will have a 24-hour emergency number and will give you advice on the next steps to take.

- Get photos or video footage of the flood damage to show to your insurer as this will help accelerate your claim. It’s also worth marking the water levels in permanent marker or something that won’t wash off the walls.

- Unless necessary for the safety of yourself or others, don’t start any repairs until you’re given the green light by your insurer.

- Don;t throw away any flood-damaged furniture or electrical items until you’ve cleared it with your insurer.

- It can take months for your home to fully dry and your insurer should be able to provide you with an estimate of how long it should take and provide driers and dehumidifiers to speed up the process.

- Bear in mind that just six inches of fast-flowing water is enough to knock you off your feet, so don’t enter any fast moving water. In addition, stay away from any standing water if you think the electrics are still on.

- Make sure you keep a record of all correspondence you have with your insurer, making a note of times and dates of phone calls and emails, as well as a record of who you spoke to and any reference numbers.

- If you have to move out of your house and into temporary accommodation, keep receipts for everything you can claim back from your insurer. And make sure your insurer has a number it can contact you on at all times.

If you’ve not yet been affected by the floods, find out how to protect your home in both the short and long term.

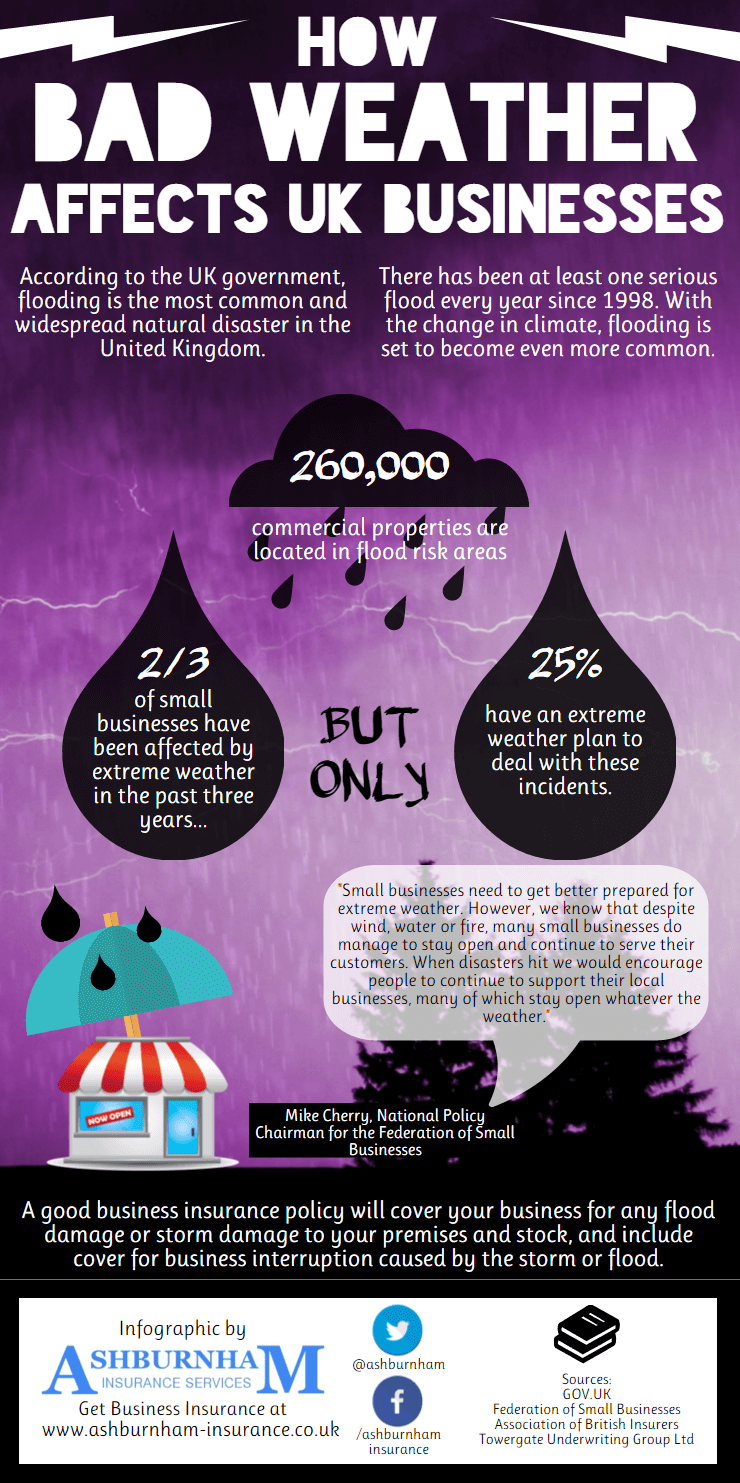

Infographic by Ashburnham Insurance